Your business have to occupy 51% in the creating: If you're paying for industrial real estate property, your business should occupy no less than 51% with the home you intend to purchase if it’s an present creating, or sixty one% from the creating if it’s new development.

See all investmentsStocksFundsBondsReal estate and choice investmentsCryptocurrencyEmployee equityBrokerage accounts529 college or university financial savings plansInvestment account reviewsCompare on the web brokerages

Intended to aid buyers make self-confident choices online, this Web page is made up of details about a wide range of products and services. Sure aspects, like but not limited to prices and Specific provides, are delivered to us directly from our associates and are dynamic and subject matter to vary at any time without prior detect.

Lender expenses on an SBA 504 loan will range substantially depending upon the procedures and essential qualifications from the lender. Although there aren’t any limits on what a lender can cost, fees remain almost always extra aggressive than most other kinds of loans.

Intelligent cash moves on your businessGet access to business insights and suggestions, plus professional content.

Bank loans. Banking companies and credit unions provide term loans and contours of credit score to set up businesses. Several have favorable conditions and related rates to SBA loans.

Sign up to acquire much more well-investigated finance articles and subject areas within your inbox, customized for you personally. This email deal with is invalid.

Enterprise listings on this webpage Will not imply endorsement. We do not characteristic all companies that you can buy. Except as expressly set forth within our Conditions of Use, all representations and warranties regarding the data presented on this page are disclaimed. The data, like pricing, which seems on This page is matter to vary Anytime

Simply because they provide unique applications, you ought to familiarize you with each selections to determine which suits your business very best. Critical takeaways

The ideal Doing the job cash loans will have a mix of small rates, easy documentation requirements, and speedy funding speeds. Loan proceeds ought to have versatile usage applicable to a variety of business purposes, with confined limits.

Savings account guideBest discounts accountsBest higher-generate financial savings accountsSavings accounts alternativesSavings calculator

This website can be a absolutely free on line resource that strives to offer beneficial articles and comparison features to our guests. We take marketing compensation from businesses that seem on the website, which may effect The placement and purchase during which brands (and/or their products) are presented, and could also effects the rating that is definitely assigned to it.

Lending specifications vary with Each individual business loan additional info company. Commonly, lenders count on great credit rating, collateral, and steady monthly revenue for acceptance. A professional lender might also request an in depth business intend to validate the organization's ability to repay the loan. What exactly is APR?

Your CDC and financial institution lender should have distinct criteria you’ll require to fulfill too. These conditions may vary, but lenders will frequently desire to see good credit rating and strong profits.

Erik von Detten Then & Now!

Erik von Detten Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Matilda Ledger Then & Now!

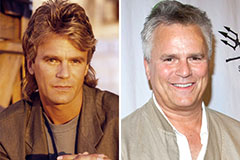

Matilda Ledger Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!